Rating Review 2025

We’re reviewing our rating system to ensure it is fair, transparent, and best reflects the needs of our district. This is an important opportunity to address inequities, make the system more adaptable, and ensure rates are calculated in a way that is in line with our community’s evolving demographics and economy.

What are we proposing to change?

We’re proposing a shift from rating based on land value to rating based on capital value. It's the system that over 65% of councils across New Zealand use.

This isn’t about increasing the total amount of rates collected—it’s about redistributing how rates are shared.

This approach considers both the value of the land and the improvements on it (such as buildings). The proposed move aims to make rates fairer by better reflecting ratepayers’ ability to pay. Moving to a capital value-based system is the fairest way to share the cost of services that are set through the general rate.

Everything is laid out in our comprehensive Proposal Document.

We’re proposing three different options for you to choose from:

Option one: No change (status quo)

Under this option, the current rates system stays the same and no changes are made. Everyone will continue to be rated on the land value system, and the current model used to generate the 2024/25 financial year forecasts will be retained.

Rates will still increase with this option in line with budgets set in the Long Term Plan, but how the burden of the increase is shared will not change.

Want to learn more about this option? Explore more in our comprehensive proposal document.

Option two: Change from Land Value to Capital Value rating

In Option 2, we'll move from rating on land value to capital value.

This would mean all rates based on land value would switch to capital value, which is generally considered to lead to a fairer and more appropriate rates allocation.

The Uniform Annual General Charge (UAGC) would also be funded differently. Instead of partially funding several activities, the UAGC would become a fixed percentage of the general rate. The change would allow our Council to better control the UAGC, making it easier to adjust for fairness and ensure the overall rates structure stays within the 30% cap for fixed charges.

Want to learn more about this option? Explore more in our comprehensive proposal document.

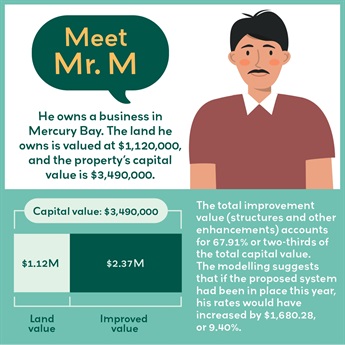

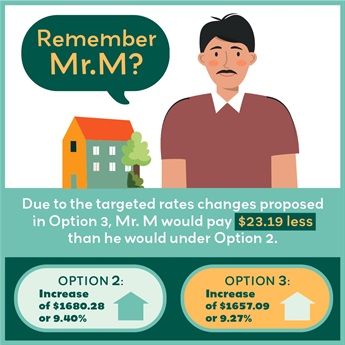

To help you understand how this option will affect different demographics, here are some real-life examples (we've just changed the names.)

Option three: Change to Capital Value rating with Targeted Rate adjustments

Option 3 is the same as Option 2 with the addition of some changes to two existing targeted rates and the general rate.

These changes correct historical allocations that no longer work with services we provide today and futureproofs the funding of these activities.

Changes to the way we rate for Rubbish and Recycling

The current Rubbish and Recycling Targeted Rate partially funds solid waste collection and transfer station activities, but administration costs are funded by the general rate. Land fill aftercare and waste minimisation activities are also funded by the general rate.

The current targeted rate is funded by those rating units that receive the kerbside collection.

Option 3 makes sure that everyone is paying their fair share.

A new rate called the Rubbish and Recycling Activity Charge would cover all costs related to transfer stations including the portion of administration costs attributed to this activity. The new rate would apply to everyone, as all ratepayers have access to and benefit from these facilities, making the system fairer and ensuring costs are more evenly distributed.

The existing Rubbish and Recycling Targeted Rate would then focus only on collection services and will include the portion of administration costs attributed to this activity.

Changes to the way we rate for Roading and Building Control

The current Roading and Building Control Targeted Rate partially funds roading and building control, with the balance made up by the general rate and the UAGC.

These two functions don’t have much to do with each other, so we want to split them up.

In this option, all funds collected from this targeted rate would fund roading only. This would mean that district roading costs would no longer be funded by the general rate and UAGC targeted rate.

Building control would now be funded entirely by the general rate and UAGC targeted rate.

Want to learn more about this option? Explore more in our comprehensive proposal document.

To help you understand how this option will affect different demographics, here are some real-life examples (we've just changed the names.)

Most ratepayers who own properties with a second dwelling need to pay rates for these dwellings. Many owners feel this is unfair, saying the income they make from renting the second dwelling out for holidays and weekends barely covers the extra rates and costs of renting out the space. We’re looking to change the way we charge for Separately used or inhabited parts (SUIPs) to decrease the burden on affected ratepayers.

We've presented three options:

- Option one: Status quo

- Option two: Change to SUIP Policy

- Option three: Change to the Rates Remission Policy to apply 100% remission to second units if conditions are met

Our preferred option proposes to change the Rates Remission Policy statement #7 (Rating units containing two separately habitable units) to give an automatic 100% rates remission to second minor dwellings that meet the qualifying criteria. Currently, second minor dwellings that meet the existing criteria receive an automatic 50% remission.

You can read more about these options in our comprehensive proposal document.

So, what does this mean for you?

To help ratepayers understand the three proposed options, we’ve developed an interactive tool called the FairShare Calculator.

To help ratepayers understand the three proposed options, we’ve developed an interactive tool called the FairShare Calculator.

The FairShare Calculator effectively models what your rates would have been this year under each of the three proposed options.

All you need is your property address, and you’ll be able to see what your rates will look like under the three proposed options.

Click here to explore our FairShare Calculator

Our preferred option works to:

- Implement a fairer system that better reflects the true value of properties.

- Align our rating system with the majority of other NZ Councils who rate based on capital value, not land value.

- Share the cost of services more equitably between ratepayers.

- Increase flexibility for our district as we grow and change.

Want to get involved?

Your input is critical in shaping the future of our rating system. Here’s how you can get involved:

Online Community Meeting: This is taking place on Monday 28 April at 6pm on Microsoft Teams. You can find more information here.

Use our FairShare Calculator: See the proposed changes and their potential impact on you.

Use our FairShare Calculator: See the proposed changes and their potential impact on you.

Attend our online public meeting: Join us to learn more and ask questions. Dates for public meetings will be published soon - in the meantime, you can register to be notified of these dates by joining our e-newsletter.

Attend our online public meeting: Join us to learn more and ask questions. Dates for public meetings will be published soon - in the meantime, you can register to be notified of these dates by joining our e-newsletter.

Attend a community catch-up session: We’ve scheduled a few catch-up sessions where you can come and talk.

Attend a community catch-up session: We’ve scheduled a few catch-up sessions where you can come and talk.

Provide feedback: Share your views through our consultation process from Thursday 10 April.

Provide feedback: Share your views through our consultation process from Thursday 10 April.

We’ll be asking for your thoughts from Thursday 10 April to Monday 12 May.

You can give your feedback in a variety of ways:

By working together, we can create a rating system that is fair, transparent, and suited to the unique needs of our district.